Message Thread:

SBA Economic Injury Disaster Loans

3/21/20

I posted this in another thread but I think this information is important for small business owers to be aware of.

It would be helpful that this thread only have actuall experience with SBA and the loan app so we can help each othter.

SBA Economic Injury Disaster Loans

These are loans for economic injury from crovid-19 if you sustain economic loss you can borrow money and stretch it out over 30 years. Interest not to exceed 4%.

My banker wants us to think about applying now in case it goes real south.

If you are hit from lack of sales this can help, Its an online app.

I am just providing this for information for those that may want to take advantage.

We may apply to replace the working capital that we consume over the next few months just keeping the bills paid.

A-

https://disasterloan.sba.gov/ela/Information/EIDLLoans

SBA Loan info

3/22/20 #2: SBA Economic Injury Disaster Loans ...

Website: mcgrewwoodwork.com

Website: mcgrewwoodwork.com

I took advantage of your post yesterday thanks

3/22/20 #3: SBA Economic Injury Disaster Loans ...

Website: http://www.lustigcabinets.com

Website: http://www.lustigcabinets.com

Is there any truth to the 100% forgiveness for these loans? I read about a Wisconsin bill, not sure if passed or proposed. Any bills for Illinois, national? Thanks, be safe.

3/23/20 #4: SBA Economic Injury Disaster Loans ...

Thanks Alan,

Going to talk to the accountant today.

3/25/20 #5: SBA Economic Injury Disaster Loans ...

I had a lengthy discussion with my banker on Monday.

The key points he made were

1) this isn't 2007,2008,2009 we want to help and will be able to help

2) they want us to project 1,2,3 and 4 months being closed so they can increase our line of credit as we need it.

3) we discussed the Economic Disater loans and he said he would walk us through it. My point was we won't know how much we need until the hole is dug.

His point was they will increase our line as needed and we can apply later for long term funding if we want.

My suggestion is speak with you baker, if you don't have a line of credit then see if you can get one or go to the link in the first post and get economic relief. There are also incentives to pay you employees paid leave coming next week.

Stay safe, keep bidding and selling, this to shall pass.

Alan

3/26/20 #6: SBA Economic Injury Disaster Loans ...

For the most part I've been taking a wait and see approach as I've finished up some WIP. But the more I think about it, I just don't see how demand comes back until a vaccine is available, which is estimated to be 18 months away. Sports stadiums empty, colleges empty, restaurants empty, airplanes empty, cruise ships empty. The list goes on.

A loan to get me through 2 or 3 months is useless if this goes on for 18 months. On the other hand, if the economy tanks for 18 months, we're all screwed.

I have no idea how to approach this.

3/26/20 #7: SBA Economic Injury Disaster Loans ...

Matthew,

First call you banker and see what they can do, then go to the SBA. I would assume 2-4 months of downtime, so you can still sell into the future when there will be work. Figure out your fixed overhead and costs to keep open for 4 months without sales. If you take draws instead of a paycheck then calculate that in.

That is the amount you want to borrow from the SBA. Even if you have 4-6 months of cash, in 2-3 months your working capital is being depleted, thats what you want to use the 30 year low interest loan for.

I expect margins to get tighter so it may take more sales dollars to reacpture the same overhead so you may need more working captial, you can always truy and borrow more than you need and pay it down when you don't need it.

Its coming from your tax money, its there to help you. Take advantage of it.

Just develop a plan, work with you accountant and or banker to help guide you through the next few months.

Alan

3/27/20 #8: SBA Economic Injury Disaster Loans ...

Alan,

Again, I'm trying not to be too pessimistic. I'm curious what you are basing 2-4 months of downtime on? We've all lived through recessions. But if you look at the unemployment numbers, this is depression level. And with a vaccine 12-18 months away, I'm not seeing any trigger that brings the economy back before then.

3/27/20 #9: SBA Economic Injury Disaster Loans ...

The main thing about the current situation is that this is Not like 2008

Recessions are usually caused by over investment. There was a lot of over investment in 2008.

There is no over investment in 2020

What drives the economy is growth in the working age population. The reason the economy stalled in 2007 was a shrinking working age population, the reason the economy has grown for 10 years with out a recession is a growing working age population.

If you want to predict the future you just look at how many people are being born, there is No hocus pocus to this.

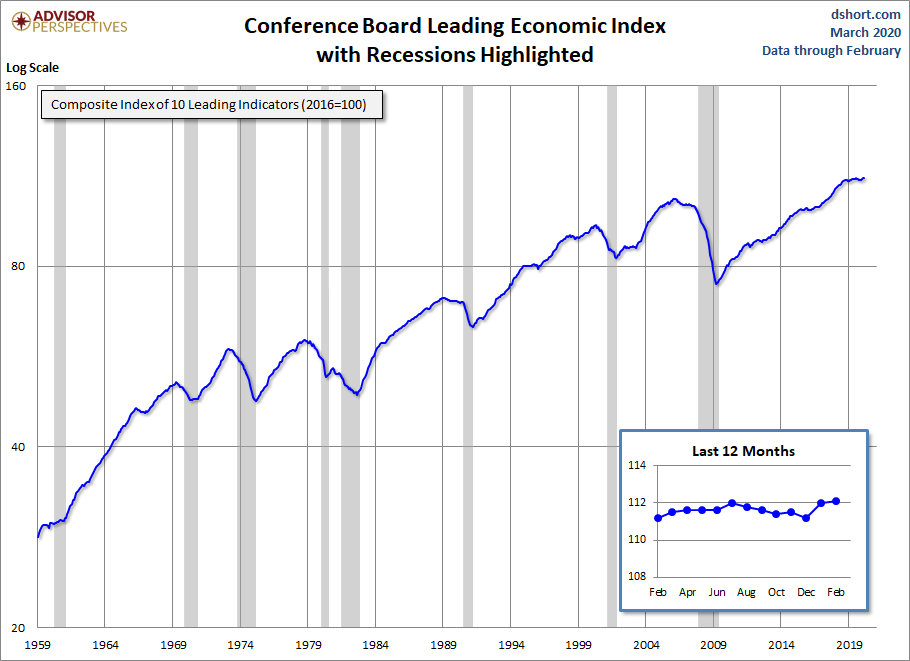

The Leading economic indicators were very strong until the current situation started.

We will start recovering from the recession around the beginning of September. Unless the virus goes exponential, which is doubtful.

The trend is your friend, look at the trend

View higher quality, full size image (910 X 661)

3/27/20 #10: SBA Economic Injury Disaster Loans ...

Pat,

The dilemma I see is that we are going to get the virus in check in a few months, but it cannot be eradicated and the vaccine does not yet exist.

At that point, the majority of the population remains uninfected. Are those people going to get on a plane? Are they going to go out to dinner? Are they going to go to a concert or a football or baseball game? I would say most will not. Most older (wealthy) people will not want people coming into their homes installing cabinets. Business conventions will either be scaled WAY back or cancelled.

This all goes on until a vaccine is ready.

3/27/20 #11: SBA Economic Injury Disaster Loans ...

Matthew

That is true and hard to predict for sure, at some point the hyperbole will settle down though and life will continue.

People who get the virus will cease to be a carrier after they recover. That can't happen unless people are exposed to it.

Currently the numbers are shocking but that is with a small percentage being tested

As the testing increases the denominator will increase and the percentages will come down.

I like what Mike Rowe said about this.

Safety 3rd

3/27/20 #12: SBA Economic Injury Disaster Loans ...

Matthew,

There is another discussion about the virus, in yesterdays press conference it was discussed that they have lifted some of the restrictions on timelines and the government is taking some of the risk from the labs so if they have a viable idea it will be green lighted now.

They discussed what they do in Africa for aids and using the same models. Short answer is either DR. FAUCI or Dr. Birx said they expect a vaccine for health care workers by the fall, they expect a POC test in 6 months (Dr.s office, result in 15 minutes).

All of the discussions that use an 18 month model are not paying attention to what the government is actually doing to remove the barriers in solving the problem. The 18 month models are 5 years old based on old methodology.

Dr Birx stated the the worse case models that have been published are not what they are seeing on the ground and the worse case models did not assume intervention.

For those that want to discuss CORVID-19 please use the other thread, this was meant to be about financial help.

So for business financing I am planning on a 2-4 month disruption. If you are in NYC it may be longer. They are working on real time data reporting at the county level for the whole country and expect that in the next week.

Stay safe, get prepared to go back to work when the shelter in place is lifted, keep bidding, keep selling.

Alan

3/29/20 #13: SBA Economic Injury Disaster Loans ...

There are new loan guidlines that should be clear in the next day or two.

They have added 367B in small business loans that cannot exceed 2.5 times payroll, rent and utilites.

It appears these loans will be through your local bank.

If you are broke right now apply for a SBA express loan and ask for a 10k advance, you will have the advance in 3 business days.

A-

3/31/20 #14: SBA Economic Injury Disaster Loans ...

Sorry for the formatting, this is from the ABA, forwarded by my banker.

You should ask you bank for an application otherwise go direct ot the SBA

A high level summary, take last years payroll, utilities, health insurance, payroll taxes, rent and divide x 12, then multiple by 2.5. (cap your wages at 100k) Thats the loan amount, you can apply for more but the 2.5x will be forgiven.

This is in addition to the loan from the other day. these loans are at .5% interest, two year term, whats not forgiven is due in two years

Subject: SBA - PPP Loans Update

ABA DAILY NEWSBYTES‌

ABA

BREAKING NEWS

Treasury Issues Guidelines, Application Form for SBA Paycheck Protection Program

Applications to Begin April 3

The Treasury Department today issued much-anticipated guidance for the Paycheck Protection Program, which starting this week will provide up to $350 billion in fully forgivable loans to help small businesses maintain payrolls during the coronavirus pandemic. The loans are fully guaranteed by the Small Business Administration, but the SBA will waive all SBA guaranty fees. PPP loans are made for two years at a 0.5% fixed rate with payments deferred for six months.

‌

All banks, as well as a broad range of nonbanks, are eligible to make PPP loans. Existing SBA-certified lenders will be given delegated authority; others must be approved before making loans. Banks that have not yet been certified with the SBA should submit an application to delegatedauthority@sba.gov. The SBA will quickly verify that banks applying are federally regulated, and new applicants will be able to process applications as soon as Friday, according to a senior administration official.

‌

To underwrite PPP loans, lenders will need to verify that the borrower was in operation on Feb. 15, 2020, and that it had employees for whom it paid salaries and payroll taxes. The lender will also have to verify the dollar amount of average payroll costs. The SBA will not review loan applications, according to a senior administration official, but lenders will receive an SBA loan number and verify that the applicant has not already received a PPP loan.

‌

The SBA will pay the lender a processing fee calculated on the loan balance, ranging from 1% for loans of over $2 million to 5% for loans of $350,000 or less. PPP loans may be sold in the secondary market, and the SBA will not collect fees for guarantees sold. The guidance includes fee caps for agents assisting with loan applications.

‌

Small businesses and sole proprietorships—generally, those with 500 or fewer employees—may apply for PPP loans starting on Friday, April 3; independent contractors and self-employed workers can apply starting April 10. PPP loans will be fully forgiven when used for payroll costs, interest on mortgages, rent and utilities, with at least three quarters of the forgiven amount being used for payroll; forgiveness is based on employers maintaining headcount or quickly rehiring and maintaining salary levels.

‌

PAYCHECK PROTECTION PROGRAM (PPP) INFORMATION SHEET:BORROWERSThe Paycheck Protection Program(“PPP”)authorizes up to $349 billion in forgivable loans to small businesses to pay their employees during the COVID-19 crisis.All loanterms will be the same for everyone.The loan amounts will be forgiven as long as: The loan proceeds are used to cover payrollcosts, and most mortgage interest, rent, and utility costsover the 8 week period after the loan is made; andEmployee and compensationlevelsare maintained. Payrollcosts are capped at $100,000 on an annualized basis for eachemployee. Due to likely high subscription, it is anticipated that not more than 25% of the forgiven amount may be for non-payroll costs.Loan payments will be deferred for 6months.When can I apply? StartingApril 3, 2020, small businesses and sole proprietorships can apply for and receive loans to cover their payroll and other certainexpensesthrough existing SBA lenders.StartingApril 10, 2020, independent contractors and self-employed individualscan apply for and receive loans to cover their payroll and other certain expenses through existing SBA lenders. Other regulated lenderswill be available to make these loansas soon as they are approved and enrolled in the program.Wherecan I apply?You can apply through any existing SBA lender or through anyfederally insured depository institution, federally insured credit union,and Farm Credit System institutionthat is participating. Other regulated lenders will be available to make these loans oncethey are approved and enrolled in the program. You should consult with your local lender as to whether it isparticipating. Visit www.sba.govfor a list of SBAlenders. Who can apply? All businesses–including nonprofits, veterans organizations, Tribal business concerns, sole proprietorships, self-employed individuals, and independent contractors–with 500 or fewer employees can apply. Businesses in certain industries can have more than 500 employees if they meet applicable SBA employee-based size standards for those industries (click HEREfor additional detail). For this program, the SBA’s affiliation standards are waived for small businesses (1) in the hoteland food services industries(click HEREfor NAICS code 72 to confirm);or (2) that are franchisesin the SBA’s Franchise Directory(click HEREto check); or(3) that receive financial assistance from small business investment companieslicensed by the SBA.Additional guidance may be released as appropriate.

What do I need to apply? You will need tocomplete the Paycheck Protection Program loan application and submit the application with the required documentationto an approvedlenderthatis available to process your applicationby June 30, 2020. Click HEREforthe application.What other documents will I need to includein my application?You will need to provide your lender with payroll documentation.Do I need to first look for other funds before applying to this program? No. We are waiving the usual SBA requirement that you try to obtain some or all of the loan funds from other sources (i.e.,we are waivingthe Credit Elsewhere requirement).How long will this program last?Although the program isopenuntil June 30, 2020, we encourage you to apply as quickly as you can because there isa funding capand lenders need time to processyour loan.How many loans can I take out under this program?Only one. What can I use these loans for? You shoulduse the proceedsfrom these loansonyour:Payroll costs, including benefits;Interest on mortgageobligations, incurred before February 15, 2020; Rent,under lease agreements in force before February 15, 2020;and Utilities,for which service began before February 15, 2020.What counts as payroll costs?Payroll costs include:Salary, wages, commissions, or tips (capped at $100,000 on an annualized basis for eachemployee);Employee benefits including costs forvacation, parental, family, medical, or sick leave; allowance for separation or dismissal; payments required for the provisions of group health care benefits including insurance premiums; andpayment of any retirement benefit;State and local taxes assessed on compensation;and For a sole proprietoror independent contractor: wages, commissions, income, or net earnings from self-employment, capped at$100,000on an annualized basisfor each employee.How largecan my loan be? Loans can be forup to two months of youraverage monthly payroll costsfrom the lastyearplus an additional 25% of that amount. That amount issubject to a$10 millioncap. If you are a seasonal ornew business, youwill use differentapplicabletime periodsfor yourcalculation. Payroll costswill be capped at$100,000 annualized for eachemployee. How much of my loan will be forgiven? You will owe money when your loan is due if you use theloan amount for anythingother than payroll costs, mortgage interest, rent, and utilities payments over the 8 weeks after getting the loan. Due to likely high subscription, it is anticipated that not more than 25% of the forgiven amount may be for non-payroll costs. You will also owe money if you do not maintain your staff and payroll.

Number of Staff: Your loan forgiveness will be reduced if youdecrease yourfull-timeemployeeheadcount.Level of Payroll: Your loan forgiveness will also be reduced if youdecrease salaries and wages by more than25%for any employee that made less than $100,000 annualized in 2019. Re-Hiring: You haveuntil June 30, 2020 to restoreyourfull-time employment and salary levels for any changes made between February 15, 2020 and April 26, 2020. How can I request loan forgiveness?You can submit a requestto the lender that is servicing the loan. The requestwillincludedocuments that verifythe number of full-time equivalent employees and pay rates,as well as the payments on eligible mortgage, lease, and utility obligations. You must certify that the documents are true and that you used the forgiveness amount to keepemployees and make eligible mortgage interest, rent, and utility payments.The lender must make a decision on the forgivenesswithin 60 days.What is my interest rate?0.50% fixedrate.When do I need to start paying interest on my loan? All payments are deferred for 6 months; however, interest will continue to accrue over this period.When is my loan due? In2years.Can I pay my loan earlier than 2years?Yes. There are no prepayment penalties or fees. Do I need to pledge any collateral for these loans? No. No collateral is required.Do I need to personally guarantee this loan? No. There is no personal guarantee requirement. ***However, if the proceeds are used for fraudulent purposes, the U.S. governmentwill pursue criminal chargesagainst you.***What do I need to certify? As part of your application, you need to certify in good faiththat:Current economic uncertainty makes the loan necessary to support your ongoing operations.The funds will be used to retain workers and maintain payroll or to make mortgage, lease, and utility payments.You have not and will not receive another loan under this program.You will provide to the lender documentation that verifiesthe number of full-time equivalent employees on payroll andthe dollar amounts of payroll costs, covered mortgage interest payments, covered rent payments, and covered utilities for the eight weeks after gettingthis loan.Loan forgiveness will be provided for the sum of documented payroll costs, covered mortgage interest payments, covered rent payments, and covered utilities. Due to likely high subscription, it is anticipated that notmore than 25% of the forgiven amount maybe for non-payroll costs.All the information you provided in your application and in all supporting documents and forms is true and accurate. Knowingly making a false statement to get a loan under this program is punishable by law.

You acknowledge that the lender will calculate the eligible loan amount usingthetax documents yousubmitted. Youaffirm that the tax documents are identical to those yousubmitted to the IRS. And youalso understand, acknowledge,and agree that the lender can share the tax information with the SBA’s authorized representatives, including authorized representatives of the SBA Office of Inspector General, for the purpose of compliance with SBA Loan Program Requirements and all SBA reviews.

https://sbaloanprogram.com/paycheck-protection-program/

4/1/20 #15: SBA Economic Injury Disaster Loans ...

Here are the docs, call your bank

I hope you all saw you can apply for a fully forgivable PPP loan, basically its fully burdened payroll (wages, FICA, SDI, health insurance you pay, 401k contributions) for last year /12 x 2.5 for the loan amount, interest only at .5% if you bring your employees back to work its forgivable is it used for

all the payroll items plus unities, mortgage or rent.

Also available for sole proprietors and 1099 workers. See your bank, applications can be made tomorrow.

A

Click the link below to download the file included with this post.

Paycheck_Protection_Program_Application_3_30_2020_v3_2.pdf

Click the link below to download the file included with this post.

PPP____Overview_2.pdf

Click the link below to download the file included with this post.

PPP__Fact_Sheet___Borrowers_2.pdf

4/4/20 #16: SBA Economic Injury Disaster Loans ...

Applied with my bank yesterday. Very easy

4/5/20 #17: SBA Economic Injury Disaster Loans ...

Received an update from my bank today that our loan was approved by our bank and they are submitting to the SBA today, so I guess the banks and the SBA really are working non stop. That is encouraging.

4/7/20 #18: SBA Economic Injury Disaster Loans ...

How many businesses that are applying for this loan are truthfully answering question #1:

"Current economic uncertainty makes this loan request necessary to support the ongoing operations of the applicant".

And if you're not lying about question #1 and you can't sustain operations, then you probably shouldn't remain in business anyway.

I guess I'll be lying like everyone else. What choice do I have, not taking the free money puts me at a competitive disadvantage.

4/7/20 #19: SBA Economic Injury Disaster Loans ...

GGFL,

In answer to your question, I did answer truthfully to question 1 and I do need the loan to sustain my business.

I manufacture and supply components to cabinet and millwork shops in my area. Just as people flocked to the stores and hoarded toilet paper and everything else they could get their hands on, the shops have hoarded their cash on hand and are hanging onto it until the uncertainty goes away.

I have a 15 employee's.

This has, and is, impacting me enormously.

I trust you are still paying your suppliers on a timely basis while maintaining payroll and covering the overhead that still needs to be paid.

Mark

4/8/20 #20: SBA Economic Injury Disaster Loans ...

Mark,

Everything I have worked for the last 10 years has been in anticipation of this inevitable event. My business has made it through recessions in 1990, 2000, 2010 and now 2020. See a pattern? Don't tell me this wasn't predictable.

Nothing resembling this amount of bail out money was available in any of the last recessions, and my business became stronger for it. Why should this be any different? Recessions are the business version of culling the herd. This grant money is allowing the sick and the weak to continue when they should be dying. If you can't make it through 8 weeks of poor sales without going bankrupt, you should go bankrupt. But now we, our children and our children's children all get the privilege of repaying trillions of dollars in additional debt as a result of this bailout.

I'm not against government assistance for the workers, I understand how important it is. But the PPP is a redundant program. The federal govt is already sending out stimulus checks that should more than make up for the difference between the unemployment check amount and what they would typically make. In my state, they're even giving out $600 a week additional.

And yes, all of my expenses are paid.

4/15/20 #21: SBA Economic Injury Disaster Loans ...

Signed our loan docs yesterday, expect the funds in our bank today or tomorrow.

9 business days from app to approval to docs to funding, that's pretty fast for a bank.

Banker said it felt like trying to drink water from a fire hose the last two weeks.

Our local bank did 300M in loans, they get paid from the SBA when we we ask for forgiveness or term it out in 8 weeks.

They get 5% from the government for all the fees, risk, etc.

A-

4/17/20 #22: SBA Economic Injury Disaster Loans ...

Applied for the EIDL 3 weeks ago, and have not heard anything. Personal stimulus appears yesterday. But the one I really needed was the PPP plan. I applied when the site first went up, but then they added this form and that. Then a few more, then my bank wanted more. At 19 pages, I had it all together yesterday and scanned into a single PDF, ready to submit--- And the webpage shifted and the money was gone and I was locked out.

4/18/20 #23: SBA Economic Injury Disaster Loans ...

David

I applied for the PPP as soon as I could, My bank told me yesterday the money was gone as well. A contractor friend who applied though Chase bank was told the same thing.

But at least Amazon and the other big boys got there PPP loans......

4/18/20 #24: SBA Economic Injury Disaster Loans ...

Ya-all dont seem ta undastand whats taken place here .

I explained once before in 2008 and was laughed off a here.

Member Econ101 ???

4/18/20 #25: SBA Economic Injury Disaster Loans ...

David,

We did our app with our bank, they approved the loan amount and then sent the loan for approval.

We used a simple spreadsheet plus submitted a bunch of backup (see photo) .

I suggest you make sure you have all the docs in with your banker for a loan and ask that they be ready to submitt or approve if they get more funding.

National Association of Manfuactuers is trying hard to get congress to approve more money, the link below contacts your representatives.

Email me if you want a blank spreadsheet of what we did and I will get it to you Monday.

We applied to OUR BANK on 4-1 , loan was approved by the bank on Suinday the 5th and they submitted on monday the 6th, SBA approved on the 7th.

Our local bank is a SBA lender so that helped and they had all our current financials from Febuary when they renewed our Line of credit.

I think becuase the banks are loaning thier own money and then getting repaid in 8-10 weeks they loaned to their customers first.

We didn't do anything online, it was all phone calls and emails with our accountant looped in.

Hopefully you can get approved in the 2nd round once congress gets off their butt.

A-

View higher quality, full size image (578 X 445)

Nam Letter to congress

4/21/20 #26: SBA Economic Injury Disaster Loans ...

We opened a business interruption claim with out insurance company today.

From our broker

New Important COVID-19 Insurance Considerations for you

Hello [xxxx (their first name)]

As the impacts of COVID-19 impact global economies we understand many of our clients could be experiencing delays, lost revenues, direct exposure to contaminated individuals, etc.

As you might be aware, the matter of insurance with respects to coronavirus is in a dynamic state of flux. As it stands now, many insurance policies will contain various exclusions that could challenge claim acceptance. However, it is too soon to understand if any potential government action could provide additional avenues for your coverage and successful claims recoveries to apply in the future.

With that said, for your potential claims recovery many insurance policies contain a “notice of loss” provision associated with coverage that places a requirement on you for the timely and accurate reporting of any potential claim(s).

We would advise that if you are experiencing a business interruption loss due to COVID-19 that you notify us so we can assist in filing a claim on your behalf.

The attachment accompanying this email “COVID-19 CLAIMS GUIDELINES AND GENERAL GUIDANCE” are offered for your reference by type of insurance coverage you may have.

Ultimately, we all need to evaluate actual losses our companies may be sustaining and try to anticipate if there are losses or types of losses you have not considered. Please seek to document and to preserve evidence, whether through witness statements, video cameras, testing results, intake reports, accounting records or other evidence to support your potential claim down the road.

We remain here, virtual and operating remotely at this time, (not in our office) to assist you if you have any questions when you need us.

We wish you all the best through these trying times.

Best Regards,

|